I wanted to write a post about how manufacturing in North America is still a vital part of our, and the world’s, economy. While I was looking for facts and data, I came across this gem of a blog authored by Dr. Mark J. Perry, Professor of Finance and Business Economics at the School of Business, University of Michigan- Flint, on his blog Carpe Diem. He makes a great case.

Enjoy!

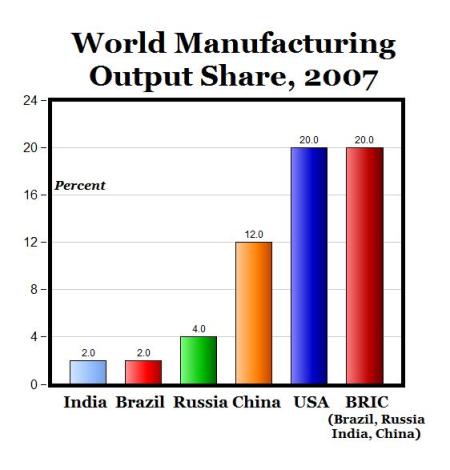

The chart above shows manufacturing output of selected countries and the BRIC countries, as a share of world manufacturing output in 2007, using United Nations data via the BLS (I haven’t been able yet to find comparable data for 2008). It’s interesting that U.S. factories produced almost twice as much output in 2007 as China, and the U.S. produced an amount equivalent to the total manufacturing output of the four BRIC countries combined (Brazil, Russia, India and China).

And as a Cato Study concluded in 2007, “Reports of the death of U.S. manufacturing have been greatly exaggerated.”

And as David Brooks wrote in 2008, “Instead of fleeing to Asia, U.S. manufacturing output is up over recent decades. As Thomas Duesterberg of Manufacturers Alliance/MAPI, a research firm, has pointed out, the U.S.’s share of global manufacturing output has actually increased slightly since 1980.”

According to the Federal Reserve data, the U.S. produced almost $3 trillion of industrial output in 2008, measured in 2000 dollars (or about $3.7 trillion in 2008 dollars). In other words, if the U.S. manufacturing sector had been counted as a separate country, it would have been tied with Germany as the world’s fourth largest economy, behind the U.S. (non-manufacturing), Japan, and China, and ahead of the entire economies of France, U.K., Italy and Russia (data here).

Bottom Line: The U.S. is still the world’s largest manufacturer.

Author: speakingofprecision

PMPA is actively working on Capitol Hill,

as well as with the Administration and business groups, to extend the Net Operating Loss (NOL) carry-back tax provision to support companies who will incur losses in 2009.

Through our lobbying firm, The Franklin Partnership, we are hearing that Senate Democrats are considering adding a four-year net operating loss carry-back provision to bills being considered this week. The tax provision would enable unprofitable companies to obtain immediate cash refunds on taxes they paid over the prior four years, instead of the usual two years.

The proposal floated by Senate Majority Leader Harry Reid (D-NV) and Senate Finance Chairman Max Baucus (D-MT) falls just short of our hope to extend refunds to cover the previous five years. However, this is a VERY important step needed to help small manufacturers who are suffering today and inject immediate cash in to their businesses. Extending the loss carry back period to 5 years will allow small businesses to recover cash that could be used to help pay debt or invest in equipment and people in this difficult time.

Please support PMPA’s efforts on the NOL provision and contact your Senators and Representative, by clicking here, to urge them to support extending the NOL carry-back provision to five years and covering losses incurred in 2009.

Its really up to you.

http://capwiz.com/pmpa/issues/alert/?alertid=14223241

Now that manufacturing is two months into expansion, September 2009 ISM Report , our short list of long delayed purchases will once again be under serious consideration. Here are 6 reasons to throw out your old list and start a new one.

- It’s not the old economy. It’s no longer business as Mayberry RFD anymore.

This is your grandfather's economy.

What you were looking at before the recession was what you needed for a prerecession economy. That’s not today. - Your suppliers have been busy. Making improvements, reducing costs, increasing capabilities of their products. Machines, tools, and software especially. What may have been a “lock” 6 months ago may in fact be a dog compared to currently available offerings.

- Your customers have changed. Some have gone away, and some have lost your trust. Do you really want to buy something that is single purpose for an account that you can’t trust?

- Your market focus has changed. The lessons your team learned in this downturn are what your customers will continue to buy from you and what they didn’t (won’t). Maybe what you were planning on buying was to produce something for the stuff that hasn’t been selling these days…

- Your needs are really, really different today. When you first made that shopping list, your planning assumptions included readily available bank credit, solvent customers, 16 million plus auto sales in US and full employment in your shops. Today availability of credit is iffy, customers that remain are slow to pay, and auto sales are not likely to top 12 million. The headcount in your enterprise has been drastically reduced. What you wanted then is NOT necessarily what you need today.

- It won’t be appropriate in your new structure. How will what you wanted back in the good ol’ days be appropriate in your shop today with half your staff on layoff and the remaining staff working OT?

Is now the time to be faithful to a dusty old procurement plan based on a vanished Mayberry RFD economy?

We have just survived the Terminator economy. Tell me again why you want to buy Andy of Mayberry’s fishing pole?

Which items on your list remain viable, and what new ones will you be adding?

![]()

The AP reported that “Ford Motor Co. said Tuesday it will add 4.5 million older-model vehicles to the long list of those recalled because a defective cruise control switch could cause a fire. ”

Photo credit: NYTimes

“The latest voluntary action pushes Ford’s total recall due to faulty switches to 14.3 million registered vehicles over 10 years, capping the company’s largest cumulative recall in history involving a single problem.”

Here is a list of the latest affected vehicles: 1995-2003 Ford Windstar; 2000-2003 Ford Excursion diesel; 1993-1997 and 1999-2003 Ford F-Super Duty diesel; 1992-2003 Ford Econoline; 1995-2002 Ford Explorer; 1995-2002 Mercury Mountaineer; 1995-1997 and 2001-2003 Ford Ranger; and 1994 Ford F35 Motorhome vehicles.

Our relevant question: Are the defective parts, reportedly produced by Texas Instruments, produced here in North America? Or were these safety critical parts produced overseas in order to obtain the lowest globally available price?

Just answer the question, please.

Photo credit: NYTimes

China is currently spending its reserves buying natural resources all around the world that will be needed in the next century.

Meanwhile, the US Government is wasting trillions of dollars of future taxpayer liabilities propping up zombie banks, Fannie Mae & Freddie Mac, and two thirds of the uncompetitive Detroit based U.S. auto industry. Trillions!

Which of these strategies seems smarter to you?

![]()

PMPA staff recently reviewed the Department of Homeland Security’s Chemical Facilities Anti-Terrorism Standards (CFATS) Regulation information posted on the web.

We reviewed the Appendix A for materials and chemicals that might be in our shops.

And we gave our members our professional ‘techie’ opinion about this rule based on our knowledge of industry materials and processes. PMPA MEMBERS ONLY CFATS BULLETIN.

This is an example of the kinds of “Tools You Can Use” Business Intelligence that PMPA provides to our members- identification of and technical assistance with the constant flood of new government regulations.

How do you identify emerging regulations in your company? Who is responsible for identifying applicability and compliance? Ultimately, we know who the courts would say is responsible…

![]()

Deutsche Bank reports that Class 8 truck orders for July were 9100 units, up 8.8% from June’s 8360. June’s 8360 was up 16.5% from the May low of 7176. The last of the EPA07 Truck orders will drive incremental production increases in Q4 2009 and Q1 2010 according to their global markets research report.

Deutsche Bank’s forecast for industy sales of Class 8 trucks is 90,000 for 2009; 125,000 for 2010. That’s the good news.

The downside is that the USEPA’s Heavy-Duty Highway Diesel Program Rules required new engines will increase costs.

“The introduction of new engines in 2010 may impact fuel economy, routine vehicle maintenance, and operational costs,” according to the ATA website.

Not to mention anticipated increase of cost of the new compliant class 8 engines: “Class 8 engine costs are expected to increase substantially in beginning in 2010 much like they did in 2007.” (Source : ATA website , emphasis ours.)

” Navistar said that its exhaust gas recirculation technology will increase International truck prices by up to $8,000 for the 2010 model year. Depending on the specific engine model a truck uses, prices will be $6,000 or $8,000 higher due to compliance with the Environmental Protection Agency’s emissions standards, which go into effect January 1.” Source: Transport Topics

Inferences for the precision machining industry- the US Heavy Truck Market is on the mend, and thanks to the rules already on the books, we can expect yet another round of cost increases for freight to bring us our raw materials and to ship our products to our customers. For those of us making parts for this new generation of engines, this is good news, but it’s inflationary effects will be felt by us all.

How do we spell inflation?

E-P-A-D-I-E-S-E-L-R-U-L-E-2-0-1-0

![]()

Medical Instruments is one market area that offers the strongest prospects for value added growth over the next few years. MX: Business Strategies for Medical Technology Executives, in its May/June 2008 edition, estimates that the medical device market will reach sales of $336 billion in 2008.

Medical Instruments is one market area that offers the strongest prospects for value added growth over the next few years. MX: Business Strategies for Medical Technology Executives, in its May/June 2008 edition, estimates that the medical device market will reach sales of $336 billion in 2008.

Aging population and baby boomers’ demand for active lifestyles supports a strong market for precision medical components in the short and long term. Here are 5 reasons for your precision machining company to consider serving the medical market:

1) Demographic makeup of the U.S. population is promising for future growth in the biotech industry.

2) Private equity investment in biotech grew more than two fold during each year between 2003 and 2007. Investment trends will remain strong as medical devices companies continue to innovate and deliver safer and more advanced solutions.

3) Aging population, longer life expectancy, and an increase in chronic illnesses will help the biotechnology industry in the both the near and long term.

4) Healthcare products and supplies revenue will be generated heavily from orthopedics, cardiology, diagnostic imaging, pain management, and oncology in the near term.

5) The outlook for demand of high-tech medical products such as hospital beds, sterilization equipment, and blood analyzers is high because of the aging demographics.

The medical device market is about 50 percent of the world pharmaceutical market, and it is growing faster than the drug market. The medical devices market was $336 billion in 2008.

Value added (sales less cost of materials) is a strong determinant of growth for sales to the markets served by the precision machining industry. Value added is not expected to be positive in the near term for all industries. Value added is expected to remain high for medical market.

What has your shop identified as the most compelling reasons to enter the medical machining market?

Can transporter beams be far behind?

University of Oxford Scientists led an international team that created this material first described in Star Trek IV The Voyage Home.

The scientists hit an aluminum target with a short pulse of extremely high energy (more power per pulse than an entire city’s worth of consumption) which knocked out an inner core electron in each aluminum atom without disturbing the metal’s crystalline structure.

The result was a 40 femtosecond period of time where the aluminum was transparent to ultraviolet radiation. “What we have created is a completely new state of matter nobody has seen before,” states Professor Justin Wark.

Commercialization remains a few years away- the transparent aluminum created was less than 1/20th the diameter of a human hair. And seeing as how a femtosecond is 1 millionth of a billionth of a second (that’s 1.0 times 10 to the minus 15th power) 40 femtoseconds (40 millionbillionths of a second) means that this stuff is somewhat- uhh- perishable. No word on the machinability either. Nevertheless, it’s one more item to check off our Life List of Cool Stuff We Need To Invent. Congrats to the Oxford team.

Now, how many screw machine parts will they need for a prototype Transporter Machine and its power supply? If the team from the Enterprise came to your shop, could you help them make the parts they need? What items are on your Life List of Cool Stuff We Need To Invent?

Productivity-What Can I Do Today To Make My Shop The Most Money?

In the current economy, many machines are down for lack of work. This makes it essential to assure that the ones with work are up and running every minute that they should.

Can you meet this simple challenge in your shop? For every production machine that you have scheduled for operations, does it have actual production uptime of greater than 50%? Actually measured in minutes of tools in the cut. Reported. Documented. Reviewed.

Any item that steals machine uptime is stealing money from your business.

Here are 7 steps you can take today to increase machine productivity in your shop:

- Record and investigate the causes of machine downtime in your shop.

- Record frequency – how many.

- Record severity– how long.

- Record by machine.

- Prepare a Pareto Analysis.

- Assign a cross functional team to investigate root causes.

- Implement corrective actions and review their effectiveness.

Solutions to system problems nearly always require a team approach. Have the team study the issues identified in the Pareto Analysis not just as specific delays, but as classes of delays. Then they can work on uncovering, and eliminating the organizational root cause of that class delay. In my experience, root causes are often institutional failings- inadequate training, inadequate maintenance, false economy on tooling, all of which are systemic problems requiring management attention.

“Quality is everybody’s responsibility,” I often heard when I was on a crew.

“The authority to permanently eliminate the root cause rests with management,” is what I muttered under my breath.

You are the Champion. The final arbiter.

Your team will identify the problems, find the root causes, and identify possible permanent solutions.

As champion your job is to help them “Make it so.”

Pareto Analysis , authored by Duncan Haugey, was found on the Project Smart website. http://www.projectsmart.co.uk/. Project Smart was launched in 2000 as a way to provide easy access to information about the project management profession.